Navigating the world of financial planning can be a daunting task, especially when trying to find an advisor who truly has your best interests at heart. A good financial advisor can be an invaluable asset, guiding you through complex financial decisions and helping you to achieve your long-term goals. However, it’s vital to remain vigilant, as not all advisors are created equal. Here are five red flags that may suggest your financial advisor might not have your best interests at heart.

1. They’re Not Fully Transparent About Fees

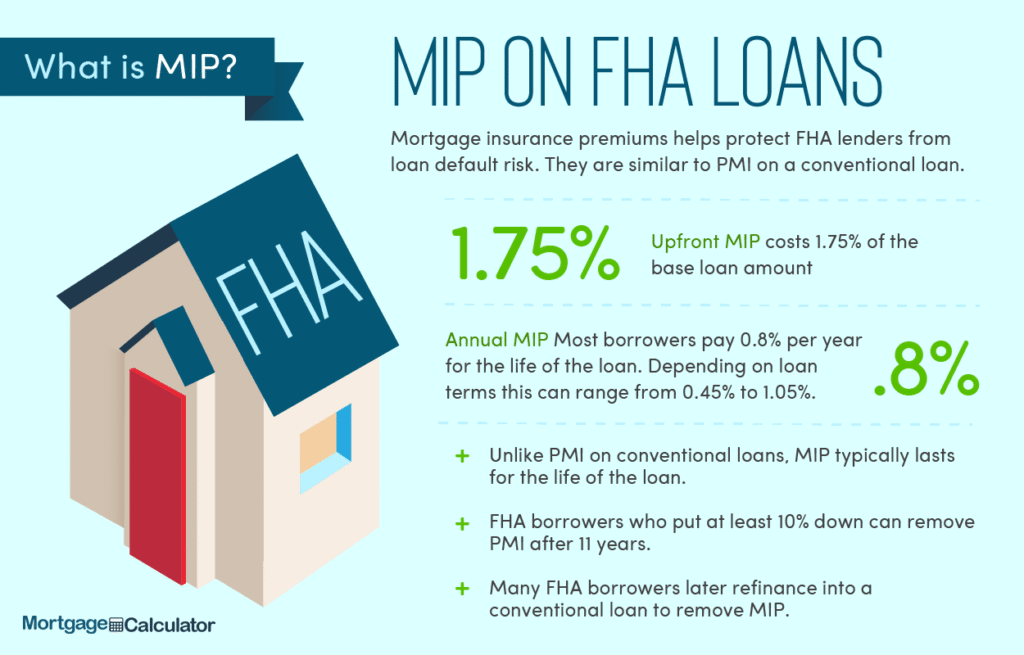

Transparency is key when it comes to the fees associated with your investments and the services provided by your financial advisor. If your advisor is not clear about how they are compensated, or if you find unexpected fees on your statements, this could be a sign that they’re not putting your interests first.

2. They Push Their Own Products

Some advisors may have incentives to push certain products, even if they aren’t the best fit for your financial situation. Watch out for advisors who seem more interested in selling you specific products than in understanding your financial goals and needs.

3. Lack of Customization in Financial Advice

Your financial situation is unique, and your financial plan should be as well. If your advisor is providing generic advice that doesn’t take into account your individual goals, needs, and risk tolerance, it may be time to look elsewhere.

4. Not Listening or Discounting Your Concerns

A good financial advisor will listen to your concerns, answer your questions, and adjust your financial plan as needed. If your advisor dismisses your concerns or seems uninterested in your questions, it’s a clear sign that they are not fully invested in your financial well-being.

5. Excessive Trading in Your Account

High levels of trading within your account can generate fees and taxes, which may benefit your advisor more than you. If you notice an unusual amount of trading activity, it might be time to have a conversation about the strategy behind these decisions.

In conclusion, finding the right financial advisor involves careful research and due diligence. Be on the lookout for these red flags, and don’t be afraid to ask tough questions about your advisor’s experience, approach, and how they’re compensated. Remember, a good financial advisor should feel like a partner in your financial journey, not just a service provider.

Frequently Asked Questions

How often should I review my financial plan with my advisor? It’s advisable to review your financial plan at least once a year or whenever you experience a significant life change, such as a marriage, the birth of a child, or a job change.

What should I do if I spot these red flags? If you notice any of these red flags, bring up your concerns with your advisor. If the response is unsatisfactory, consider seeking a second opinion or looking for a new advisor.

How can I ensure that a potential advisor has my best interests at heart? Look for advisors who are fiduciaries, meaning they are legally required to act in your best interest. Additionally, do your due diligence by researching their background and asking for references.