If you’re a veteran, active-duty service member, or an eligible surviving spouse looking to purchase a home in Iowa, you may already be aware of the benefits offered by VA loans. One of the most significant advantages of a VA loan is the competitive mortgage rates. But what exactly goes into determining these rates, and how can you ensure you’re getting the best deal on your home loan?

In this blog post, we’ll explore VA mortgage rates in Iowa, the factors that influence them, and tips for securing the most favorable rate for your situation.

What Are VA Loans?

VA loans are backed by the U.S. Department of Veterans Affairs and are designed to help military members and their families achieve homeownership. Unlike conventional loans, VA loans typically don’t require a down payment, private mortgage insurance (PMI), or high credit scores, making them an attractive option for many borrowers.

One of the most appealing features of VA loans is the ability to secure lower interest rates compared to conventional loans. This can save homeowners thousands of dollars over the life of their mortgage.

Current VA Mortgage Rates in Iowa

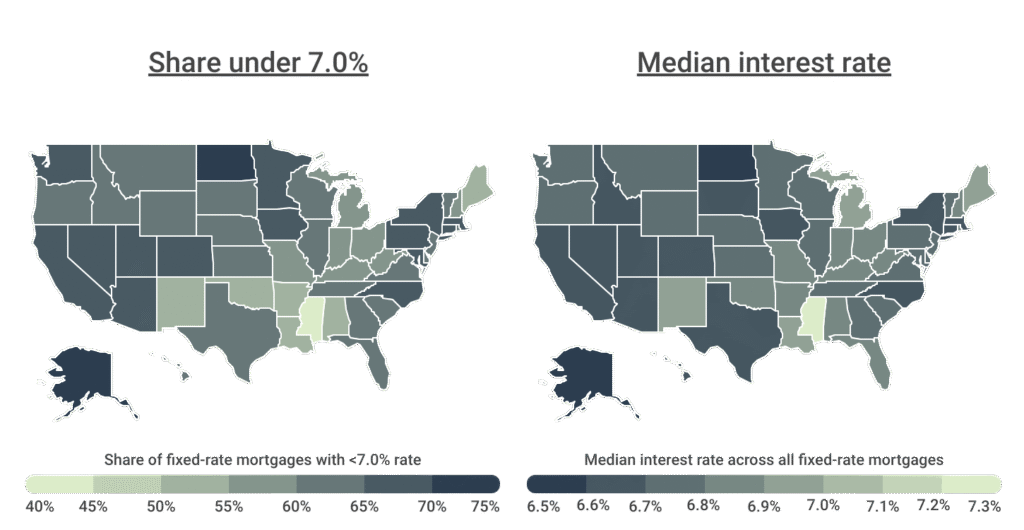

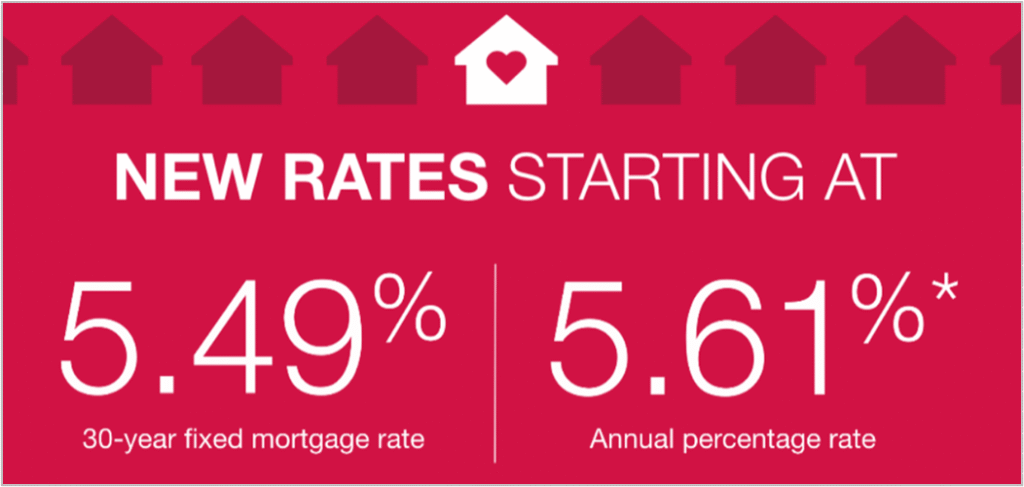

As of now, VA mortgage rates in Iowa are relatively low compared to historical averages. While rates can fluctuate daily based on economic conditions, borrowers in Iowa can often secure rates ranging from 5.5% to 6.5%, depending on their lender, credit score, and loan term.

It’s important to note that VA loan rates are not set by the Department of Veterans Affairs. Instead, they are determined by individual lenders and can vary based on market conditions. However, because VA loans are partially guaranteed by the government, lenders can afford to offer lower rates than they would with traditional loans.

Factors That Influence VA Mortgage Rates in Iowa

Several factors can impact the rate you’ll receive for a VA loan in Iowa, including:

- Credit Score

While VA loans are more lenient with credit requirements, a higher credit score can still help you secure a lower interest rate. - Loan Term

Shorter loan terms, such as 15 years, often come with lower rates compared to 30-year loans. - Economic Conditions

National and local economic trends, such as inflation and Federal Reserve policies, can influence interest rates. - Lender Policies

Each lender may offer slightly different rates, so shopping around is essential. - Loan Amount and Usage

Whether the loan is for a primary residence, refinancing, or purchasing a second home can also affect the rate.

Tips for Securing the Best VA Mortgage Rate in Iowa

- Improve Your Credit Score

Even though VA loans are flexible, a higher credit score can give you more negotiating power. - Compare Lenders

Don’t settle for the first offer you receive. Compare rates and terms from multiple lenders to find the best fit for your needs. - Lock in Your Rate

Once you’ve found a favorable rate, consider locking it in to avoid potential increases before closing. - Work With VA Loan Specialists

Some lenders specialize in VA loans and may offer better rates or more tailored assistance. - Consider Refinancing

If you already have a VA loan, keep an eye on rates. Refinancing through the VA Interest Rate Reduction Refinance Loan (IRRRL) program could help you secure a lower rate.

Why Iowa is a Great State for VA Homebuyers

Iowa offers a combination of affordable housing, a strong sense of community, and a quality of life that appeals to many veterans and their families. With median home prices significantly below the national average, a VA loan in Iowa can help you stretch your budget further while enjoying the benefits of homeownership.

Additionally, Iowa is home to several military bases and veteran organizations, providing a supportive environment for those who have served.

Final Thoughts

VA mortgage rates in Iowa offer a unique opportunity for veterans and qualifying individuals to achieve homeownership with favorable terms. By understanding the factors that influence rates and taking steps to secure the best deal, you can make the most of your VA loan benefits.

If you’re ready to take the next step, reach out to a trusted VA lender in Iowa to explore your options. Homeownership may be closer than you think!