Just like a quarterback is essential to leading a football team to victory by making strategic plays, a financial quarterback can help steer your wealth towards success by crafting and executing a personalized financial strategy. Your Financial Quarterback is not just your planner or advisor; they are a holistic coach who sees the full picture of your financial health and goals, making the right calls to ensure your financial stability and growth.

The Importance of Having a Financial Quarterback

In a complex financial landscape, having a financial quarterback ensures that all aspects of your wealth management are considered and aligned with your long-term goals. This proactive approach prevents missed opportunities and costly mistakes.

Understanding Your Financial Goals

Your financial quarterback begins with a deep dive into your desires, priorities, and objectives. Whether it’s retirement planning, tax optimization, estate planning, or investment management, understanding your goals is the first step in creating a playbook that’s tailored to you.

Creating a Personalized Financial Playbook

The strategy then shifts to developing a personalized financial playbook. This plan acts as a roadmap, detailing the specific strategies and financial vehicles that will be utilized to reach your objectives.

Investment Management

A key play in your financial playbook involves investment management. Your financial quarterback will guide you in selecting the right investments that match your risk tolerance and time horizon.

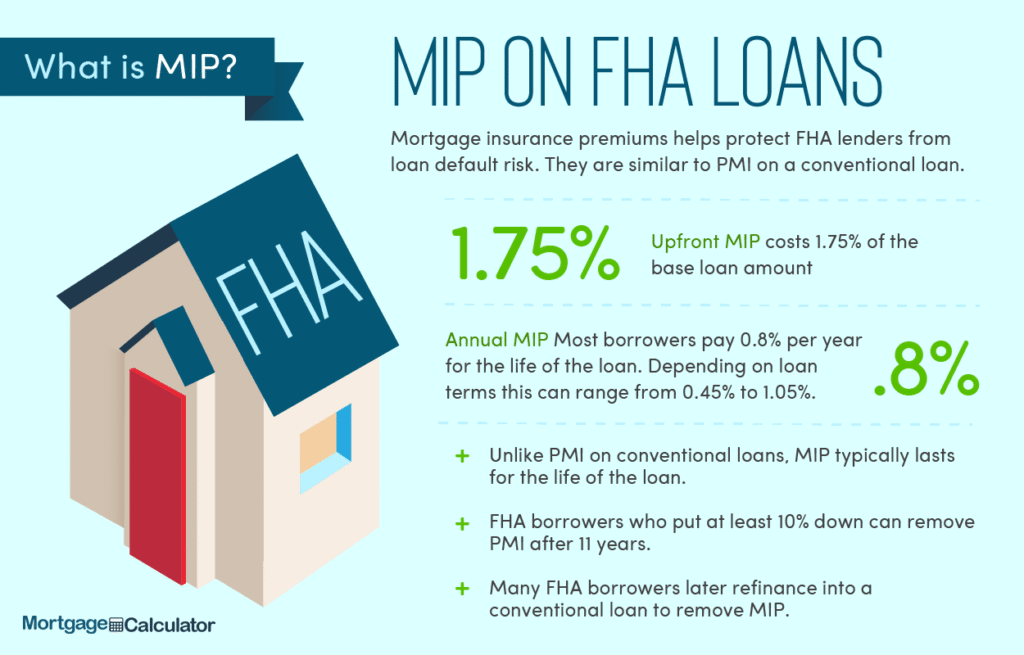

Risk Management

Risk management is crucial in protecting your assets from unforeseen events. This includes insurance, diversification strategies, and creating an emergency fund.

Tax Planning

Efficient tax planning strategies can increase your wealth over time by minimizing your tax liability and maximizing your investment growth.

Estate Planning

Estate planning ensures that your wealth is transferred according to your wishes while minimizing tax implications and legal hurdles.

Retirement Planning

Crafting a retirement plan that supports your desired lifestyle, while ensuring your wealth lasts, is a critical play called by your financial quarterback.

Adapting to Financial Changes

As your life evolves, so will your financial strategy. Your quarterback will make the necessary adjustments to ensure your plan remains aligned with your goals.

Quarterbacking Your Business Wealth

For business owners, a financial quarterback can also manage business wealth, creating synergy between personal and business financial strategies.

The Team Approach

Your financial quarterback often works with a team of specialists, including accountants, lawyers, and insurance agents, to execute your financial playbook seamlessly.

Communication is Key

Clear, consistent communication between you and your financial quarterback ensures that everyone is working towards the same end zone.

Choosing the Right Financial Quarterback

Selecting the right financial quarterback is paramount. Look for someone with experience, a holistic approach, and who places your interests first.

Benefits of Working with a Financial Quarterback

The benefits of having a financial quarterback include peace of mind, financial growth, and the ability to enjoy your life and wealth without constant worry about financial decisions.

Case Studies: Winning Financial Strategies

Through case studies, we can see the real-life impact of having a financial quarterback who called the right plays.

Looking Ahead: The Future of Wealth Management

The role of a financial quarterback will continue to evolve with technology, regulatory changes, and the shifting financial landscape. Staying ahead of these changes ensures continued financial success.

The Final Whistle

In the complex game of wealth management, having a financial quarterback who can call the right plays tailored to your unique situation is invaluable. By working together, you can navigate the financial field with confidence, making strategic moves that secure your financial future.

Frequently Asked Questions

How do I choose the right financial quarterback? Look for advisors who have a strong track record, hold relevant certifications, and whose investment philosophy aligns with your goals.

What services does a financial quarterback provide? They offer a broad range of services including investment management, tax planning, estate planning, risk management, and retirement planning.

Is it worth paying for a financial quarterback? Yes, for most people, the value of comprehensive financial planning and peace of mind far outweighs the costs.

How often should I meet with my financial quarterback? It is generally recommended to review your financial plan at least annually, or whenever there are significant changes in your life or the financial markets.

Can a financial quarterback help with debt management? Yes, part of their role is to advise on strategies for managing and paying down debt efficiently.