A “No-Spend Challenge” is a financial detox where you commit to spending only on absolute essentials for a set period. In 2026, with the rise of digital “micro-transactions” and subscription creep, this challenge is one of the fastest ways to hit a $1,000 savings goal.

Here is your step-by-step roadmap to planning a successful challenge and keeping that $1,000 in your pocket.

1. Define Your “Why” and Your “When”

A challenge without a deadline is just a wish.

- The Timeline: To save $1,000, most households need a 30-day challenge. If your discretionary spending (dining out, shopping, hobbies) is lower, you may need a 60-day “Low-Spend” hybrid.

- The Motivation: Are you building an emergency fund, paying off a credit card, or funding a 2026 summer vacation? Write this goal down; you’ll need it when the temptation to order takeout hits on a Tuesday night.

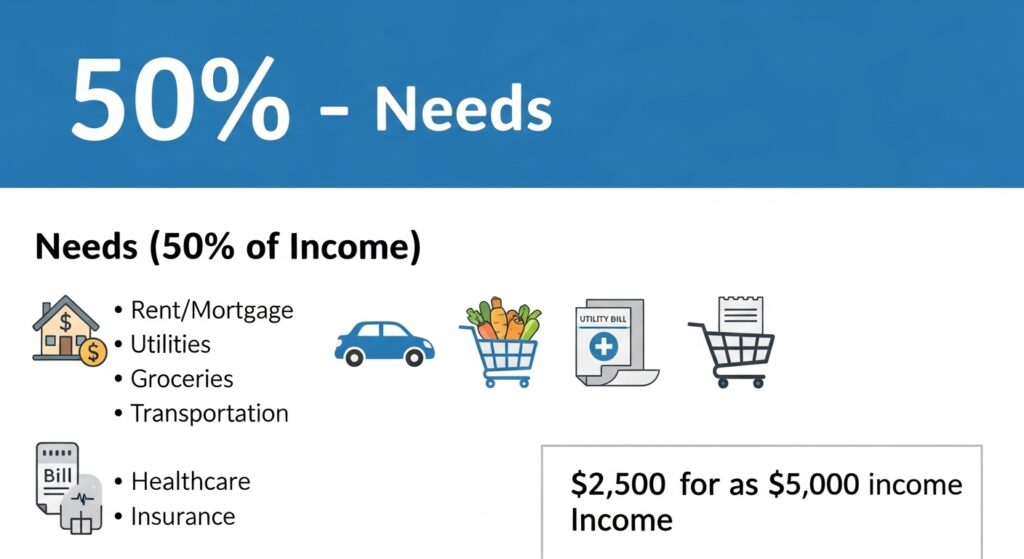

2. Set Your “Essential” vs. “Non-Essential” Rules

The secret to not quitting is clarity. Use a “Green Light / Red Light” system:

🟢 Green Light (Allowed)

- Fixed Bills: Rent/mortgage, utilities, insurance, and internet.

- Basic Groceries: Focus on “staples” (rice, beans, frozen veggies).

- Transport: Fuel or public transit for work.

- Health: Necessary medications and hygiene basics.

🔴 Red Light (Strictly Forbidden)

- Dining Out: No restaurants, no fast food, and definitely no delivery apps (delete them for the month).

- Impulse Shopping: No Amazon, Target runs, or “browsing” sales.

- Entertainment: No new movie rentals, books, or gaming micro-transactions.

- The “Convenience” Tax: No paid parking if free is available, no vending machines, and no $7 lattes.

3. The “Pre-Challenge” Audit (How to find that $1,000)

Before Day 1, look at your last 30 days of bank statements. Most people are shocked to find where their money actually goes.

- Subscriptions: Cancel or pause one or two streaming services for the month.

- Pantry Challenge: Look in your freezer and cupboards. Plan to eat through your “backstock” first. This alone can save $200–$400 in a month.

- Unsubscribe: Go to your inbox and unsubscribe from every marketing email that sends you “limited time offers.”

4. Strategies to Stay on Track

- The “Today I Wanted But Didn’t Buy” List (TIWBDB): Keep a note on your phone. Every time you skip a purchase, write down the price. Watching that list grow toward $1,000 is a massive dopamine hit.

- Use the “24-Hour Rule”: If you see something you think you “need,” you must wait 24 hours. Usually, the urge passes.

- Social Life Reset: Instead of “let’s grab drinks,” suggest “let’s go for a hike” or “come over for a board game night.”

5. 2026 Tracking Tools

Tracking is the difference between success and failure. You need a visual representation of your progress.

- Digital: Use apps like Mallow (a dedicated no-buy tracker) or YNAB to see your “Inflow vs. Outflow” in real-time.

- Analog: Print a 2026 No-Spend Calendar. Color each day green if you spent $0 on extras. If you slip up, color it red and move on—don’t let one bad day ruin the month.

6. What to do with the $1,000?

As the challenge ends, immediately move the saved money into a High-Yield Savings Account (HYSA). If you leave it in your checking account, “lifestyle creep” will claim it within weeks.